March Recap and April Outlook

The month started out on a positive note as CPI came in lower than expected, creating a brief respite from worries about the impact of tariffs. It was short-lived, as the result of the Federal Open Market Committee meeting at mid-month was policy stasis with no changes to rates. Even more unsettling to the markets was the Fed’s signal of fewer rate cuts in 2025.

Jerome Powell described the position of the Fed as “inertia,” resulting from the uncertainty created by the Trump administration’s policies. The Fed doesn’t have insight into what the administration will do, and the potential for the policies to roil the economy is clear. Supply shocks resulting from trade and immigration hard lines may create both slower growth and higher inflation, leaving the Fed with a difficult option set and no clear path to support the economy with interest rate policy.

Let’s get into the data:

- Inflation, as measured by CPI, eased. CPI rose 2.8% for the 12 months ended in February. The monthly number rose 0.2%, against expectations for a 0.3%.

- Non-farm payrolls for March came in at 228,000. The U.S. Bureau of Labor Statistics reported a far more jobs than the 140,000 that were expected, and the unemployment rate rose to 4.2% on higher labor force participation.

- Consumer expectations showed pessimism. The Conference Board Leading Economic Index® declined by 0.3% in February. The University of Michigan Consumer Sentiment Index was revised lower to 57 in March, from 64.7 in February

- Consumer spending moderated. The Bureau of Economic Analysis reported a 0.4% rise in consumer spending, lower than the consensus expectation of 5%.

- Inflation expectations increased. The University of Michigan Consumer Expectations Survey saw a jump in one-year inflation expectations to 5% from 4.3%. The five-year number came in a 4.1%, the highest since February 1993.

What Does the Data Add Up To?

The markets struggled all month as the Trump administration touted “Liberation Day” on April 2 as the announcement of tariffs. The day duly arrived and hopes that tariffs would be less punitive promptly vanished.The labor market report, out on Friday, April 4th, was much stronger than expected, but hard evidence that the labor market isn’t softening wasn’t enough to distract the stock market from the tariff tantrum.

However, the strong labor market is causing consternation that the economy may be plunged into “stagflation.” This combination of “stagnant” and “inflation” describes an economy with low growth and high inflation. Tariffs will increase production costs and consumer prices, keeping inflation high and resulting in higher interest rates as the Fed reverses course to fight inflation.

Without the “Fed put” of the Federal Reserve stepping in to lower interest rates, the economy will likely struggle to grow. As the uncertainty and negative outlook begins to discourage business investment and policies disrupt supply chains, economic growth may decline and the so-far resilient labor market may become fragile, with unemployment increasing.

What did this look like the last time it happened? In 1974, U.S. Gross National Product was declining by 4.2% annually, inflation hit 16.8%, and unemployment was 8.9%. Despite two successive administrations attempting to fix the problem, stagflation remained throughout the 1970s. The cure was the aggressive interest rate regime of Fed Chairman Paul Volker.

Against this backdrop, the current administration is calling for interest rate cuts in an attempt to keep the economy growing, but Chairman Powell has indicated he will be holding firm for now.

The depth and duration of the tariffs and resulting trade wars are unknown at this point. The administration has made several tariff announcements since the inauguration that were quickly rescinded, and that may once again be the case. Another outcome could be quick and successful negotiations with other countries. As this unfolds, market volatility is likely to remain elevated.

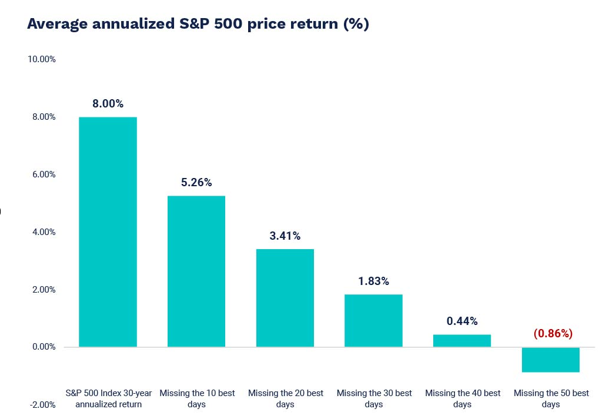

Chart of the Month: Staying the Course Wins Over Timing the Market

Source: Bloomberg and Wells Fargo Investment Institute. S&P 500 daily data from February 1, 1994 through January 31, 2024.

Equity Markets in March

- The S&P 500 was down 5.75% for the month

- The Dow Jones Industrial Average fell 4.20% for the month

- The S&P MidCap 400 decreased 5.68% for the month

- The S&P SmallCap 600 lost 6.36% for the month

Source: S&P Global. All performance as of March 31, 2025.

Two of the eleven S&P 500 sectors had positive returns, with Energy out in front with a 3.75% return. Consumer Discretionary suffered the most, down 9.02%. The month saw much higher spikes, with 12 of 21 trading days moving at least 1% and 2 days of at least 2%.

Bond Markets in March

The 10-year U.S. Treasury ended the month at a yield of 4.22%, up from 4.21% the prior month. The 30-year U.S. Treasury ended March at 4.58%, up from 4.49%. The Bloomberg U.S. Aggregate Bond Index returned 0.04%. The Bloomberg Municipal Bond Index returned -0.003%.

The Smart Investor

The conventional wisdom is that markets hate uncertainty. The first few days of April would seem to indicate that there are some certainties – like tariff announcements – that they hate even more. However, markets that dove on tariff announcements will be just as likely to pop when better headlines are made.

Chairman Powell was discussing Fed policy when he made his comment about inertia, but it’s not a bad prescription for investors as well. Making any sudden moves can result in crystalizing losses that are very difficult to turn around by trying to time the market. The data shows that it’s better to stay invested, and trim your sails prudently as new information becomes available.

Combining personal goals, investments, and a view on the economy, while ensuring that all the pieces of the financial planning process are engaged, is at the core of what a financial advisor can bring to the table. We’re always here to help.

The information on this site was produced by a third party and is provided “AS IS” without warranties of any kind either express or implied. Three Oaks Wealth does not warrant that the information on this site will be free from error. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security.