The appeal of a Roth IRA is easy to see: any money you put into the account now will grow tax free for the rest of your life. Not only that – unlike tax deferred retirement accounts like a 401k or traditional IRA, Roth IRAs don’t have any mandatory distributions in retirement. Since your contributions are made with funds the IRS has already taxed, they don’t force you to pull from the account once you reach your 70s.

This can be a powerful mix. You put money into the account now, it grows and compounds, and when you take it out everything comes out tax free. You can even skip the distributions entirely and leave the account to your kids when you die. And even though they need to take money out after inheriting the account from you, those distributions would be tax free too.

The Roth IRA is such a tremendous deal that the IRS doesn’t let you contribute to one if you make too much money. This is where the “back door Roth IRA conversion” strategy comes into play. If you make too much money to contribute to a Roth IRA directly, you might still be able to fund one by using this strategy. This post will describe just what you need to know to take advantage of the back door Roth IRA conversion in 2023.

Determine Whether You Qualify for Traditional Roth IRA Contributions

In 2023 single filers are able to contribute $6,500 to a Roth IRA if their modified adjusted gross income (MAGI) is below $138,000 for the year. Anyone over 50 may put in an additional $1,000 as a “catch up” contribution. If their MAGI falls between $138,000 and $153,000 they may make a contribution, but less than the full $6,500 limit. Those with MAGI over $153,000 are ineligible to make a contribution at all.

Married people filing jointly must have MAGI below $218,000 in order to make a full contribution, with the phaseout range begin $218,000 to $228,000.

This is where the back door Roth IRA conversion comes into play. If your MAGI is above the phaseout range for your filing status you might be able to use the strategy. If your MAGI is below the phaseout range there’s no need to explore a back door conversion. You can simply make a normal “front door” contribution by depositing cash directly to a Roth IRA.

Calculating Modified Adjusted Gross Income

So what is MAGI, specifically? Modified adjusted gross income is simply the adjusted gross income reported on your tax return with certain deductions added back:

- Deductions taken for IRA contributions and taxable Social Security payments

- Tuition and fees

- Half of the self-employment tax

- Student loan interest deductions

- Losses from partnerships

- Passive income or losses

- Interest from EE savings bonds used to pay for education expenses

- Excluded foreign income

- Rental losses

- Exclusion for adoption expenses

Modified adjusted gross income is helpful to know, since it’s also used to determine IRA deductibility and whether you’re eligible for the premium tax credit.

Non-Deductible Contributions to a Traditional IRA

Remember the difference between Roth IRAs and traditional IRAs. With the Roth IRA you make contributions with money that’s already been taxed. Distributions down the road are tax free.

Traditional IRAs are the exact opposite. You may be able to deduct contributions to an IRA, essentially making the money “pre-tax”. Those contributions grow, and when it’s time to pull from the account any distributions are taxed as income.

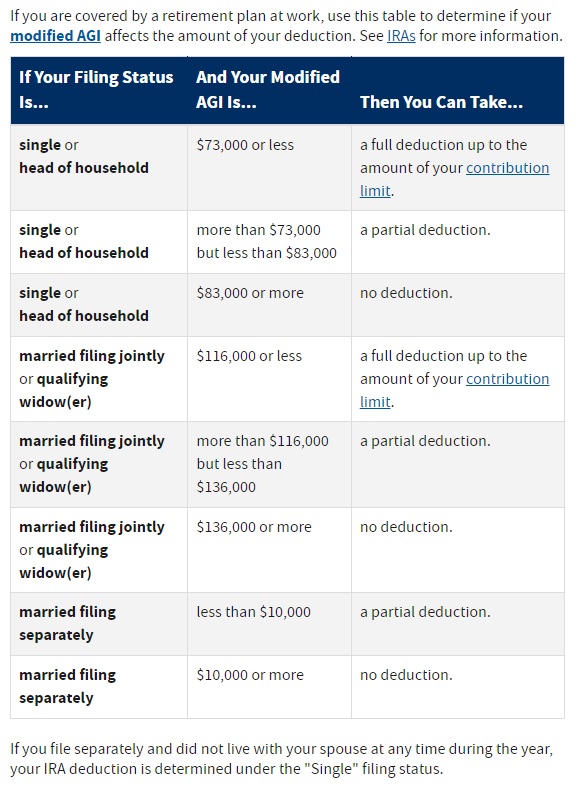

Just like the IRS restricts Roth IRA contributions based on your income, the IRS also restricts whether you can deduct contributions made to traditional IRAs. The determination is based on your MAGI and whether you are covered by a retirement plan at work.

From the IRS website, if you’re covered by a retirement plan at work:

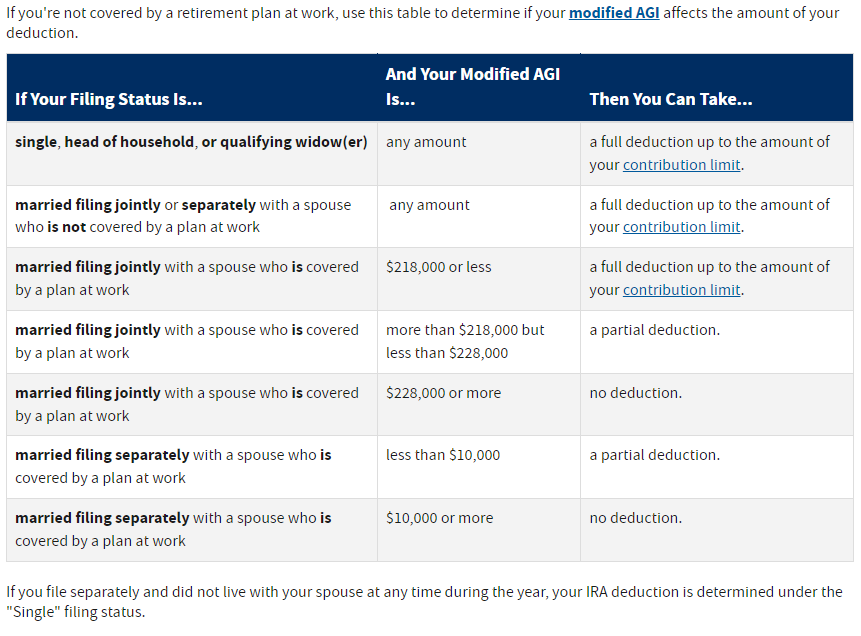

And if you’re not covered by a retirement plan at work:

Look at the IRA deduction limits, and compare them with the MAGI phaseout ranges for Roth IRA contributions. If your MAGI is too high to make a direct contribution to a Roth IRA, it’ll likely also be too high to deduct a contribution to a traditional IRA. The only exception is if you don’t have access to a retirement plan at work.

Tax Basis & Non-Deductible IRA Contributions

The reason back door Roth IRA conversions work has everything to do with basis. Basis is a tax term that has to do with whether you deduct contributions or pay tax on them. For example, let’s assume you’re a single filer who’s not covered by a workplace retirement plan. If you make a $6,500 contribution to a traditional IRA you’d be free to deduct the contributions, which would establish a basis of $0.

This means that nothing in the account has been taxed yet. It also means that when funds are distributed from the account, everything that comes out will be counted as taxable income.

Alternatively, let’s assume you are already covered by a workplace plan & your MAGI is too high to deduct the contributions. In this case a $6,500 contribution would not be deductible, meaning you’d pay income tax on everything going into the account. Since you’d pay tax on 100% of the contributions, you’d establish a basis of $6,500.

Years down the road, let’s say your $6,500 contribution grew to be $10,000. If you withdrew the entire $10,000 then, only the $3,500 of growth ($10,000 – $6,500 of basis) would be considered taxable income. Your basis could be withdrawn tax free.

The Back Door Conversion

Notice that while there is a MAGI limit to making Roth IRA contributions directly, there is no limit on making non-deductible contributions to a traditional IRA. Even the highest income earners can still put $6,500 into a traditional IRA in 2023.

This is where the back door conversion comes into play. Just like non-deductible IRA contributions, there is no income limit on conversions from traditional IRAs to Roth IRAs. You’re free to have your broker send cash or other assets from your traditional IRA to your Roth IRA with impunity. And as we covered above, once the funds are in your Roth IRA they can grow there tax free for the rest of your life.

Roth IRA conversions are a taxable event. Having your broker convert $1,000 from your traditional IRA to your Roth IRA will trigger a 1099 for $1,000 at the end of the year, which you’ll need to report on your tax return.

Fortunately, you’re able to offset these taxable events with basis. In the case of the back door Roth IRA conversion, you would make a $6,500 contribution for 2023 to a traditional IRA, or a $7,500 contribution if you’re 50 or over (provided you have at least that much earned income to justify the contribution). This contribution would not be deductible, which would establish a basis of exactly $6,500.

If you then converted those contributions to a Roth IRA, you’d be triggering a taxable event of $6,500. But by offsetting it with your basis, your total taxable income would end up being $6,500 – $6,500 = $0. Thus, the back door conversion enables you to get the full $6,500 into a Roth IRA with the same tax consequence even though you make too much money to contribute to a Roth IRA directly.

Back Door Roth IRA Pitfalls

The steps seem pretty basic in principle. You contribute $6,500 to a traditional IRA, and subsequently convert the $6,500 to a Roth IRA. Unfortunately it’s slightly more complex than that. There are a few common traps people fall into when executing back door Roth IRA conversions, including two IRS rules you should know about.

Pro-Rata Rule

The pro-rata rule is an IRS stipulation that requires you to combine market value and basis across all your IRAs in a conversion.

For example, let’s say you have $100,000 in a traditional IRA as a result of a rollover from a former employer’s 401k plan. You did not pay tax on any of the contributions, meaning that your basis in the account is $0.

If you pursued a back door Roth IRA conversion the calculus would change quite a bit. You deposit the $6,500 in another traditional IRA. But when converting to a Roth IRA, the tax impact isn’t simply the market value minus basis of these two accounts. The pro-rata rule requires that you determine the ratio of market value to basis across all your accounts.

In this case the total market value across your IRAs would be $100,000 + $6,500 = $106,500. Your basis across all IRAs would only be the $6,500 you just deposited. Which means that only $6,500 / $106,500 = 6% of your IRAs counts as basis.

Thus, converting your fresh $6,500 contribution to a Roth IRA would not quite come tax free. Only 6% of the conversion ($6,500 * 6% = $390) counts as basis. The other $6,110 ($6,500 – $390) would be considered taxable income. Essentially, $0 basis assets in other IRAs – including SEP-IRAs and SIMPLE IRAs – dilutes the value of the back door conversion.

Tracking Basis Over Time

Unfortunately, the brokerage firm holding your traditional & Roth IRAs doesn’t keep track of basis on your behalf. And as we covered above, tracking and reporting the basis of your non-deductible IRA contributions is exactly why the back door Roth IRA conversion works.

It’ll be up to you or your tax preparer to track basis on your behalf. Which is accomplished by including form 8606 with your tax returns. The form itself is not terribly complex to fill out, but programs like TurboTax will sometimes struggle with them. Any time you contribute to an IRA and are not deducting it, you should keep track of the basis by using this form. Failing to do so can lead to headaches and/or larger tax bills down the road.

Step Transaction Doctrine

The step transaction doctrine has been the subject of much scrutiny over the years as it relates to back door Roth IRA conversions. The crux of the rule is that the IRS disallows any series of legal transactions if the aggregate of them is disallowed.

The best analogy here is the law of transitivity in math. If A equals B and B equals C, A must be equal to C. In this context if you make too much money to contribute directly to a Roth IRA, any series of transactions that gets your $6,500 into a Roth IRA – even if they’re individually OK – would be disallowed as a group.

For years practitioners have devised ways to get around this loophole. I’ve spoken with numerous CPAs who claim that taxpayers should wait for two tax reporting periods (approximately 2 years) before converting IRA assets to a Roth IRA and completing the maneuver. Others will claim that you can make the contribution to a traditional IRA on day one, and turn around and convert it on day two.

Fortunately, Congress weighed in on this topic in 2018 after the Tax Cut & Jobs Act was passed: “Although an individual with AGI exceeding certain limits is not permitted to make a contribution directly to a Roth IRA, the individual can make a contribution to a traditional IRA and convert the traditional IRA to a Roth IRA.”

Congress ultimately writes the tax law. And given that Congressional intent is a substantial part of interpreting the law, most practitioners these days are more confident that the back door Roth IRA conversion does not violate the step transaction doctrine.

Nonetheless, regimes and administrations change over time. To avoid confusion and any future hassle, we typically suggest investors wait approximately one